Biden’s plan for student loan forgiveness temporarily blocked

The Eighth U.S. Circuit Court of Appeals has halted the plan while reviewing several complaints

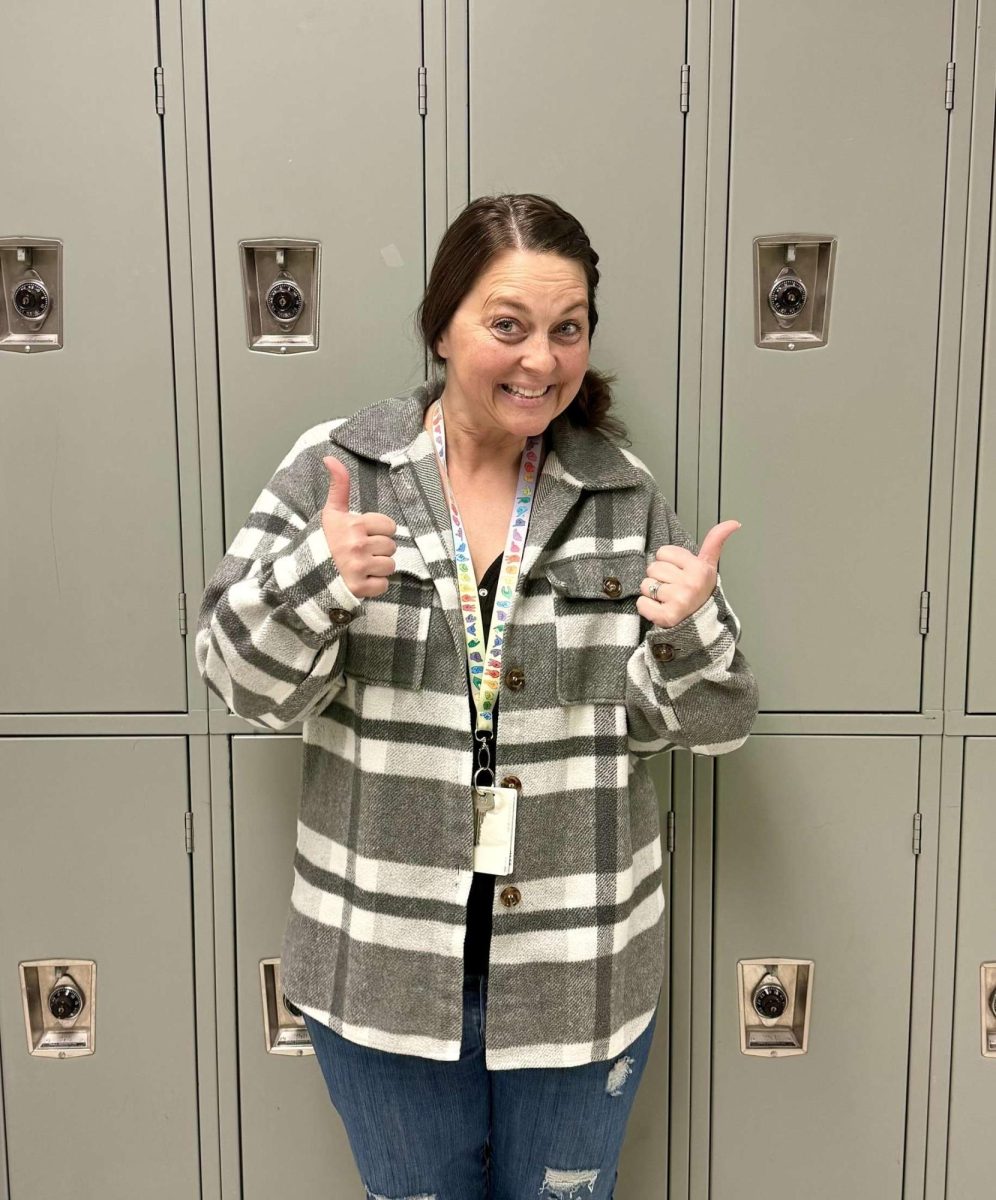

Boise State freshman Ellie Friedt enjoys her first day of college, where she gets in-state tuition.

Nov 28, 2022

College prices have been on the rise for decades, and the demand for such an education has matched this sharp incline. With more and more students matriculating into post-secondary institutions each year, financial aid in the form of federal loans has left many Americans in economic despair, a huge price tag of debt looming over their heads.

According to cnbc.com, “A college education is now the second-largest expense an individual is likely to make in a lifetime — right after purchasing a home.”

In response to this great American debt – totaling to over $1.5 trillion nationally, according to chamberofcommerce.org – the federal government has stepped in. Earlier this year, the Biden-Harris Administration announced plans for a new financial program in the states, one that would forgive millions of dollars in student loan debt. Broken into three parts, President Biden’s plan would cancel up to $20,000 in loan debt for students who received Pell Grants and up to $10,000 for students who did not. However, people within the top five percent of national incomes will not qualify for this aid.

The federal plan would then move to change the student loan system, amending the Public Service Loan Forgiveness (PSLF) program and holding universities to strict financial regulations in an effort to prevent worsening of the national debt going forward.

According to whitehouse.gov, “This Administration has already taken key steps to strengthen accountability, including in areas where the previous Administration weakened rules. The Department of Education is announcing new efforts to ensure student borrowers get value for their college costs.”

However, within just months of the plan being announced, it was met with a temporary block. The Eighth U.S. Circuit Court of Appeals has met the demands of six GOP-led states – Iowa, Kansas, Nebraska, Missouri, South Carolina and Arkansas – that have sued to halt the plan’s progression, asserting that the Biden Administration has no authority to issue such mass financial forgiveness and that the plan would hurt the states’ own loan programs. The six states had initially sued in September, but their case was dismissed by a Missouri federal judge due to a lack of standing. Now in the appeals process, their complaints will be considered again, and the block will stay in place until a decision is made.

According to usatoday.com, “In its response, the [Biden] administration said the states had failed to prove they would be affected by the federal government cancelling student loan debt, a point previously made by the district judge.”

So, what does this mean? While Biden’s Administration cannot dismiss any student loan debt for the time being, eligible recipients of this aid may still apply as the U.S. Department of Education continues to review applications. Their hope is to review and grant as many eligible applications as possible so that the process may continue steadily if and when the appeal is dismissed.